QUARTERLY REPORT

Period January – September 2023

PEPTONIC Medical AB (publ) org nr 556776–3064

(www.spotlightstockmarket.com, ticker: PMED)

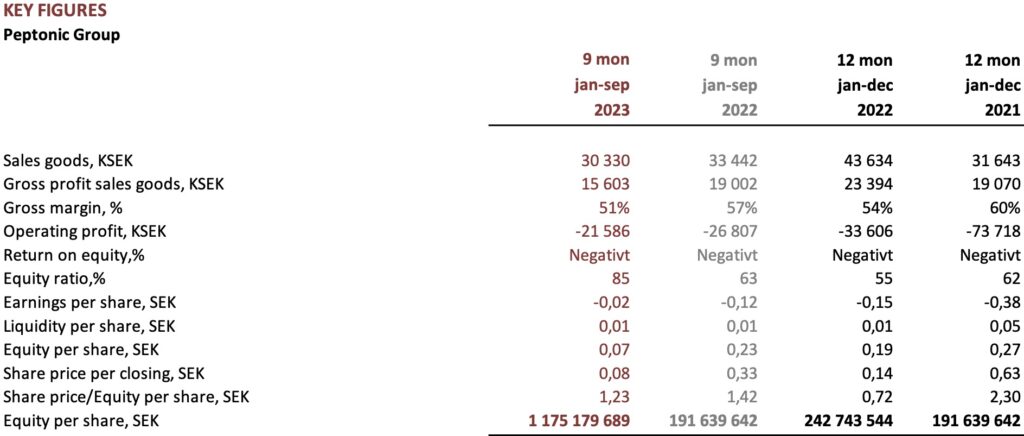

GROUP

2023 THIRD QUARTER (Jul-Sep)

- Net sales of products SEK 9 525 (12 180) thousand

- Gross profit SEK 4 517 (7 137) thousand, 47% (59%)

- Operating loss SEK -7 557 (-7 786) thousand

- Loss per share SEK -0,01 (-0,04)

2023 FIRST NINE MONTHS (Jan-Sep)

- Net sales of products SEK 30 330 (33 442) thousand

- Gross profit SEK 15 603 (19 002) thousand, 51% (57%)

- Operating loss SEK -21 586 (-26 807) thousand

- Loss per share -0,02 (-0,12) SEK

IMPORTANT EVENTS DURING THE PERIOD

• On July 7, the company announced the merger plan for Peptonics and Pharmiva’s merger. The company provided an update on the financial development for the period 1 January – 31 May 2023 against the background of the merger proposal.

• On July 11, the company announced that a license agreement had been signed with the Swiss medical technology company Prima Lab SA for the sale in Sweden of self-tests for measuring the FSH hormone.

• On 2 August, the company announced that a final merger document had been drawn up due to the planned merger with Pharmiva.

• At an extraordinary general meeting on August 21, Pharmiva’s shareholders approved the planned merger between Peptonic Medical AB and Pharmiva AB.

• On September 27, the company announces that Mangold Fondkommission AB has been appointed as liquidity guarantor for the company’s shares that are listed on the Spotlight Stock Market.

IMPORTANT EVENTS AFTER THE PERIOD

• On October 5, the company announces that an exclusive agreement regarding VagiVital’s self-test for the detection of amniotic fluid leakage has been signed with Savyon Diagnostics in Israel.

• On October 10, the company announces that an agreement has been made with the world’s largest retail chain, Walmart, to start selling Peptonic’s self-test for bacterial vaginosis.

Message from our CEO

Sales in Sweden doubled

During the third quarter, sales in the important reference market Sweden doubled compared to the same period last year. This is the third consecutive quarter that we have reached new highs. The rapid growth is due in part to a very successful summer campaign where we once again stuck our neck out, dared a little more and received a very positive response, as well as an increasing number of repeat purchases. Accumulated growth so far this year is +53% compared to the last year, while the market as a whole is growing at around 10% year-on-year. The market share of VagiVital AktivGel is now up to 10%.

Increased business flow and new partners

During the third quarter, we continued to make significant progress in our ambition to become a major player in the area of intimate women’s health. In August, the merger with Pharmiva was given the green light and now a number of formal steps remain for the merger to be completed. The merger is expected to generate revenue and cost synergies, optimise the product portfolio and strengthen the organization.

At the same time, we see an upcoming flow of business from our international partners. We have successfully signed a distribution agreement regarding our bacterial vaginosis self-test with Walmart in the US. Walmart is the largest retail chain in the US. In October, Windsor Pharma placed its first order, as did Savyon Diagnostics, with whom we recently signed a distribution agreement for the Israeli market. The orders from Windsor Pharma and Savyon Diagnostics will be delivered in the fourth quarter.

Strong pipeline of new products

During the year, we have focused on developing and in-licensing new products within the framework of our concept Diagnose, Treat, Prevent. The merger with Pharmiva adds a unique and patented treatment for bacterial vaginosis to the portfolio. In addition, we have added a urinary tract infection test and a menopause test to our offering. Next year, we expect to launch a patented product for the treatment of vestibulitis, which is the result of our own research and development. A proprietary product that prevents urinary tract infections is also in the pipeline. In total, we intend to launch ten new products in 2024 as part of our strategy to build a more complete product portfolio.

Shipping delays to Israel affect the third quarter

During the third quarter, sales declined as a result of delivery delays to our production unit in Israel and expected lower sales in the business area Lifestyle Consumer. As a result of the delivery delays, sales of approximately SEK 1.7 million have been postponed to the fourth quarter. Sales in the core business area Medical Consumer continue to grow and the gross margin is expected to increase in 2024 as a result of higher production in Israel following new partner agreements. The ongoing severe conflict in Israel has not affected our manufacturing unit in Caesarea as it is not located in the immediate vicinity of the affected areas. Both production and deliveries continue to operate normally.

Clear plan going forward for increased sales and profitability

In summary, we expect to see significant improvements from the turn of the year, when the merger with Pharmiva is completed and the business is integrated. Together with our strong portfolio of new products, the success in Sweden, the new agreements signed with our international partners, and the strengthening of the organization, we are well equipped for rapid sales growth in 2024 and the goal of reaching profitability in 2025.

Erik Sundquist

CEO

COMPANY BRIEF

Peptonic Medical AB (publ) is a Swedish innovative biomedical company that conducts research, development, and sales of unique medical treatments within women’s intimate health. Under the brand name VagiVital®️, the product portfolio includes treatments of different conditions, e.g., vaginal atrophy, bacterial vaginosis and urinary tract infections. The clinically tested products address the growing demand for intimate self-care under the business concept Diagnose, Treat, Prevent. Sweden is used as the reference market to facilitate geographical growth in partnership with local distributors. The US is the largest market in terms of sales. The company has its head office in Stockholm, Sweden, with a sales office in New York, NY, and an R&D unit in Caesarea, Israel. Peptonic Medical also has its wholly owned subsidiary Lune Oy in Finland with a focus on sustainable period products sold under the brand name Lunette®️ (www.lunette.com). The company’s shares are listed on www.spotlightstockmarket.com since 2014.

FINANCIAL INFORMATION

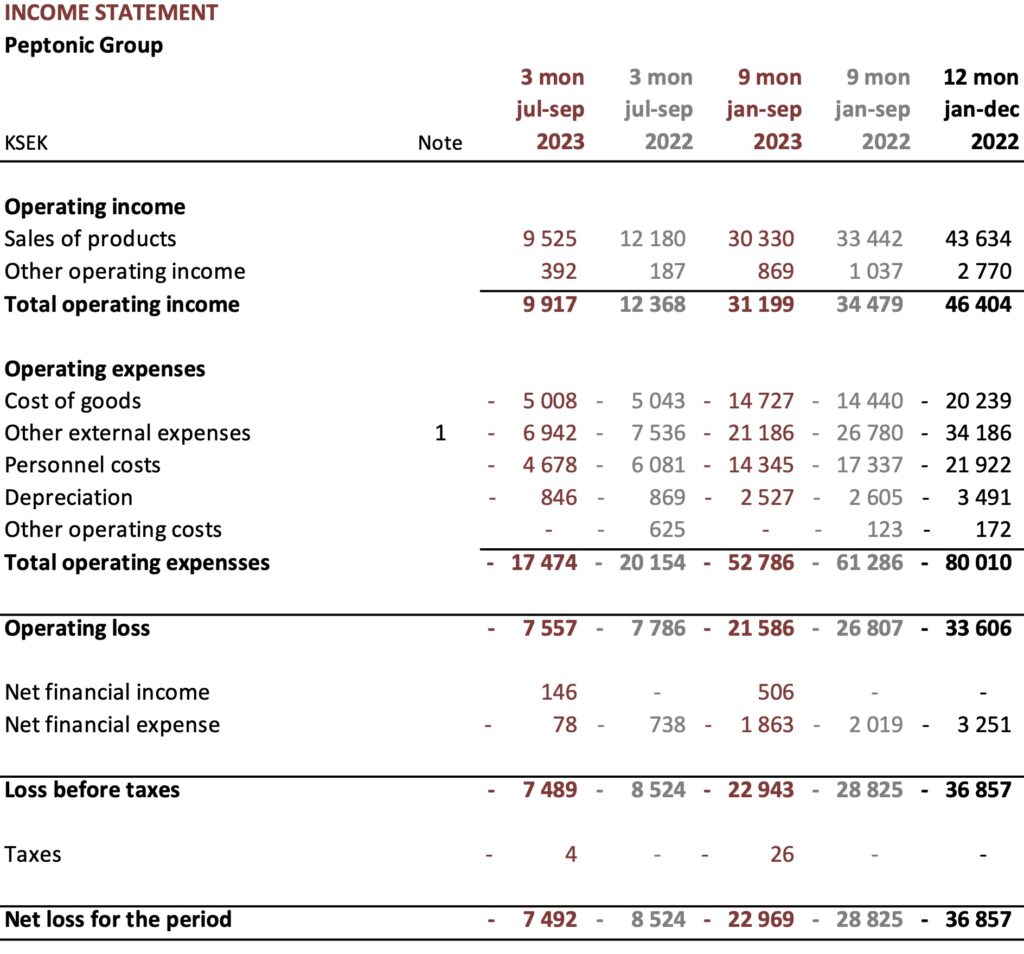

Group

Revenue– Sales of goods during the third quarter amounted to SEK 9,525 (12,180) thousand, resulting in a decrease of SEK 2,655 thousand compared to the same period last year. This decrease is primarily due to a delivery delay with a value of SEK 1,700 thousand, which will be realized in the fourth quarter. Other operating income for the quarter was SEK 392 (187) thousand. In the first nine months, sales of goods amounted to SEK 30,330 (33,442) thousand, reflecting a decrease of SEK 3,112 thousand. Other operating income for the period was SEK 869 (1,037) thousand.

The Business Segment Lifestyle has experienced a persistent decline in sales over the past year, resulting in a decrease of SEK 2 million in the quarter compared to the same period last year. The refocus toward key markets and cost control continues and has resulted in an improved operating result despite lower sales.

Excluding the delivery delay, the key business area Medical Consumer is growing compared to the same period the previous year. Particularly, the important reference market of Sweden continues to grow very rapidly, and the quarter marks the third quarter in a row as the best sales quarter so far.

Costs – In the third quarter, costs amounted to SEK -17,474 (SEK -20,154) thousand. Costs of goods sold for this quarter were SEK -5,008 (-5,043) thousand, resulting in a gross profit of SEK 4,516 (7,137) thousand and a gross margin of 47% (59%). During Q3, the gross margin was calculated using a new model for our own production, resulting in a lower gross margin compared to 2022. According to the new model, the previous year’s gross margin was 46%. Over the first nine months, product costs amounted to SEK -14,727 (-14,440) thousand, resulting in a gross profit of SEK 15,603 (19,002) thousand and a gross margin of 51% (57%). Successful cost management in this period has led to an improved operating result this quarter compared to the same period last year, despite lower revenues.

Profit – The group’s result after net financial items for the third quarter amounted to SEK -7,482 (8,524) thousand, an improvement compared to the previous despite lower sales. For the first nine months, the corresponding result is SEK -22,943 thousand, reflecting an improvement from SEK

-28,825 thousand in the same period last year.

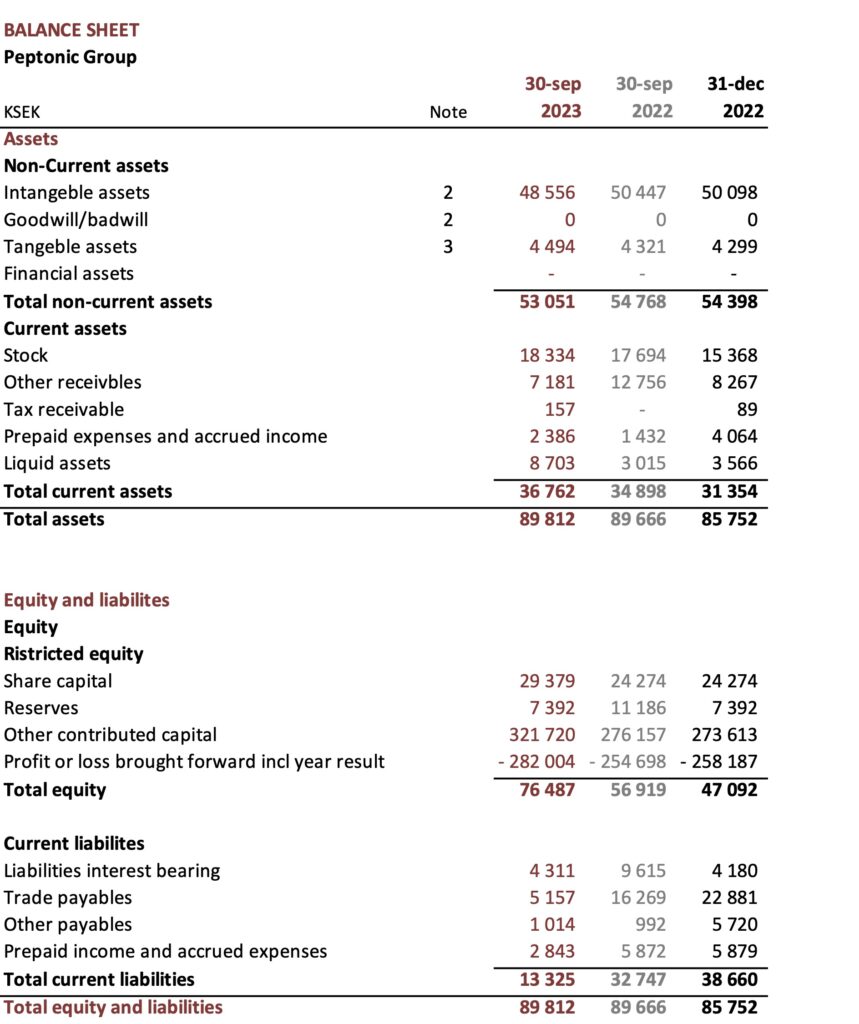

Financial position and liquidity – Cash and bank as of September 30, 2023, amounted to SEK 8,703 (3,015) thousand.

Shareholders equity – The group’s equity as of September 30, 2023 amounted to SEK 76,487 (56,919) thousand, which gives an equity ratio of 85 (64) percent.

Liabilities– The group’s short-term liabilities amounted, as of September 30, 2023, to SEK 13,325 (32,747) thousand. Of which SEK 4,800 thousand refers to interest-bearing deferrals with the Tax Agency.

Organization– During the period, the average number of employees was 31 (31). At the end of the period, the number of employees amounted to 32 (31).

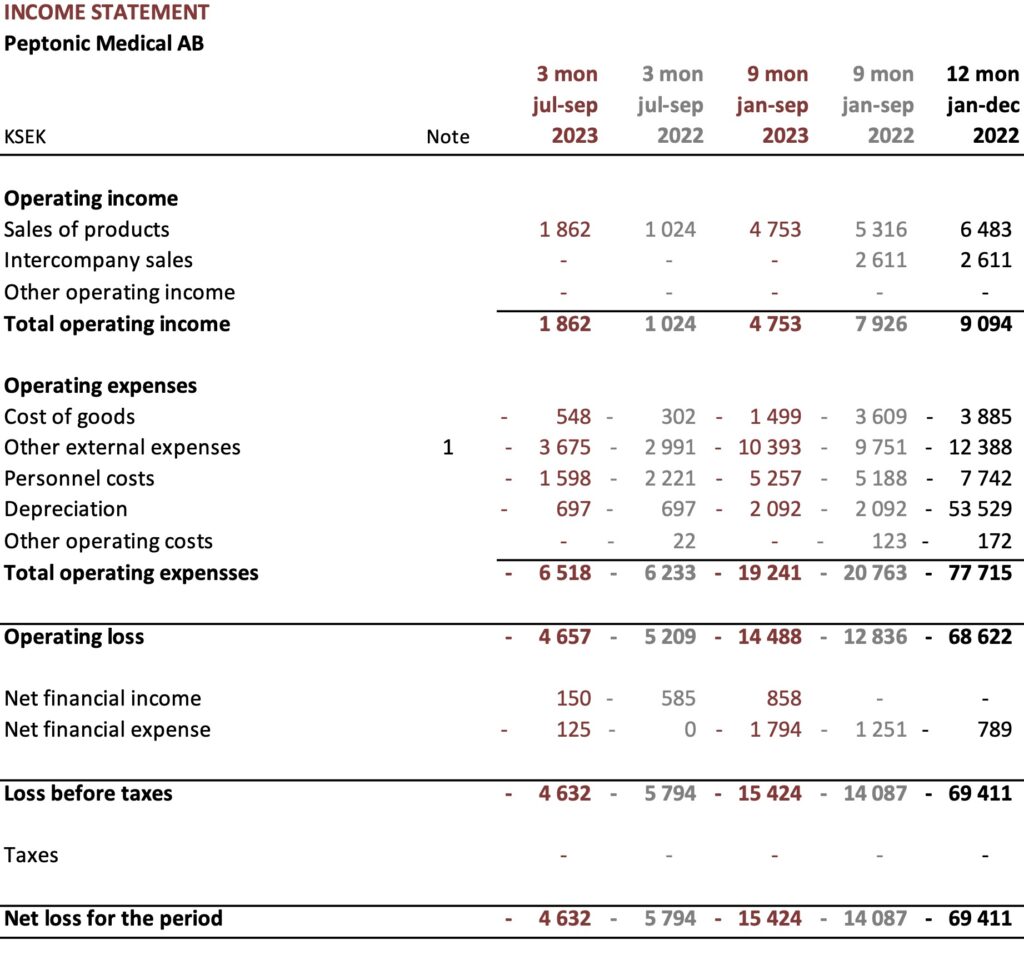

FINANCIAL INFORMATION

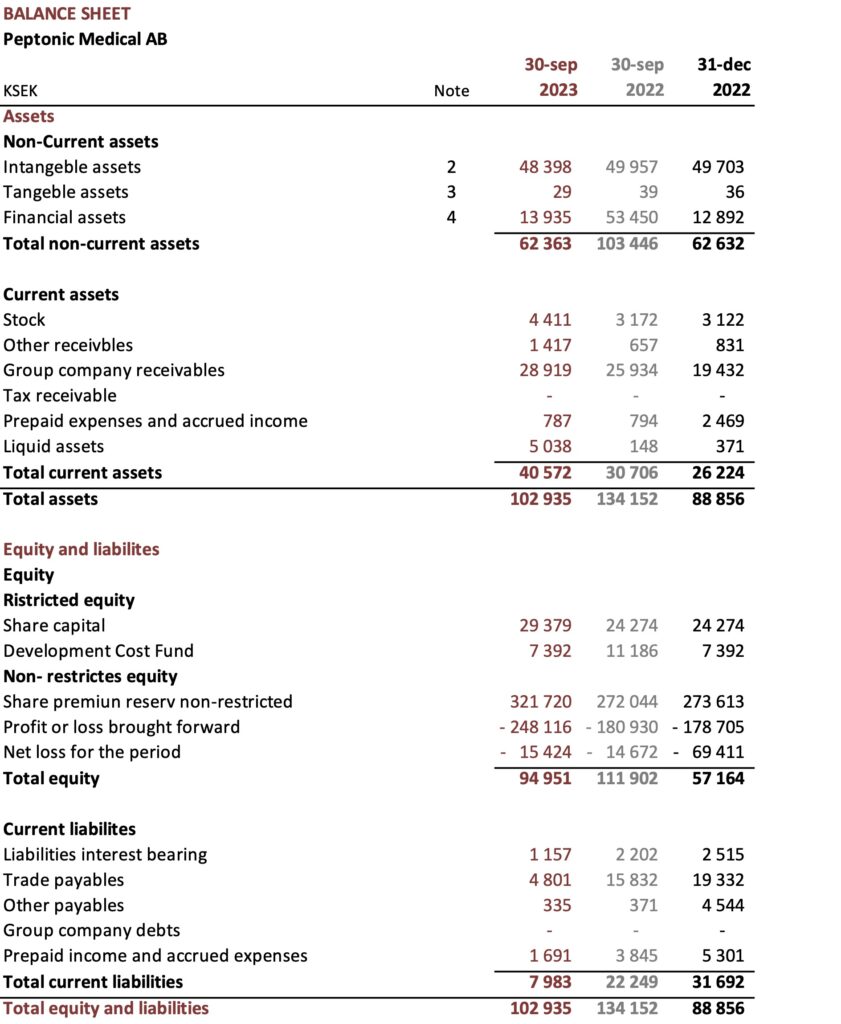

Parent company PEPTONIC Medical AB

Revenue – Sales of goods during the third quarter amounted to SEK 1,862 (1,024) thousand. Other operating income for the quarter was SEK 0 (0) thousand. For the first 9 months, sales of goods amounted to SEK 4,753 (7,926 of which 2,611 refer to internal sales) thousand.

Costs – Costs for the third quarter amounted to SEK -6,518 (-7,383) thousand. During the period, costs of goods sold were SEK -548 (-767) thousand. The costs for the first 9 months were SEK -19,241 (-20,763) thousand. During the period, costs for products have been SEK -1,499 (-3,609) thousand.

Profit – The company’s profit after financial net for the third quarter amounted to SEK -4,632 (-5,794) thousand. Profit is charged with financial costs of SEK -125 thousand, of which SEK 111 thousand refers to unrealized exchange rate differences, the financial income amounts to SEK 150 thousand and refers to unrealized exchange rate differences.

Financial position and liquidity – Cash and bank as of September 30, 2023, amounted to SEK 5,038 (148) thousand.

Shareholders equity – The company’s equity as of September 30, 2023 amounted to SEK 94,951 (111,902) thousand, which gives an equity ratio of 92 (83) percent. Utilization of warrants of series TO2, which was carried out during the second quarter, has resulted in an increase in the company’s equity of approx. SEK 9.7 million.

Liabilities – The company’s liabilities amounted, as of September 30, 2023, to SEK 7,983 (22,249) thousand, of which SEK 4,801 thousand are interest-bearing.

Organization – During the period, the average number of employees was 3 (3). At the end of the period, the number of employees amounted to 4 (3).

Share – The total number of outstanding shares as of 30 September 2023 was 1,175,179,689 (191,639,642). The number of outstanding warrants amounts to 392,741,200. If the warrants are fully exercised, the number of shares increases by 392,741,200.

NOTE

Accounting principles

This interim report has been prepared in accordance with the Annual Accounts Act (Chapter 9. Interim Report) and the Swedish Accounting Standards Board’s general advice, BFNAR 2012:1 Annual Report and consolidated (K3-rules). The accounting principles are unchanged compared to the previous year.

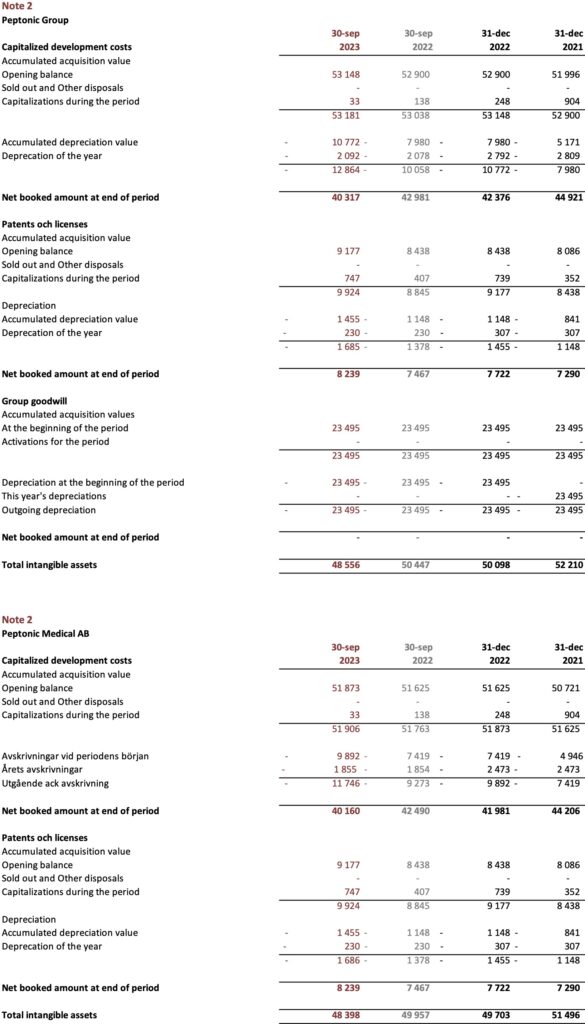

Intangible assets

Patent and development costs are capitalized and depreciated in 20 years from the first revenue that the group receives. The depreciations started in year 2019. Capitalized patent and development costs are estimated to result in future revenues for the Group. From 2019 they are depreciated at 5% per annum. Which corresponds to the estimated life of the commercial rights.

Note 1 – Other operating costs

Group/parent company

During the period companies represented by members of the Board of Directors were contracted as consultants. Total compensation for the period amounted to SEK 67 (408) thousand excluding VAT and is primarily related to business development services. All transactions between related parties are based on market conditions. No other key executives or their immediate family members have been directly or indirectly involved in any business transaction with the Company that is or was unusual in its character or terms and conditions and took place during the period.

Note 3 – Tangible fixed assets

Group/parent company

Within the group, tools for product manufacturing have been capitalized.

Note 4 – Financial fixed assets

Parent company

As of September 30, 2023, a total of 13,935 KSEK represents shares in wholly owned subsidiaries.

Audit

This year-end report has not been subject to be reviewed by the company’s auditors.

Assurance

The board and the managing director assure that the year-end report provides a fair overview of the company’s operations, position and results.

FINANSIELL KALENDER

Year-end report, 2023 2024-02-23

Stockholm on 24 of october, 2023

Anders Blom, Chairmen of the Board Daniel Rudeklint, Board member

Anna Stinger, Board member Anders Norling, Board member

Tarek Shoeb, Board member

Erik Sundquist, CEO

For more information please contact:

Erik Sundquist, CEO PEPTONIC Medical AB. Phone: +46 722 499 043

Note: This document has been prepared in both Swedish and English. The Swedish version shall govern in case of differences between the two documents. The document contains certain statements about the Company’s operating environment and future performance. These statements should only be regarded as reflective of prevailing interpretations. No guarantees can be made that these statements are free from errors.