Peptonic is a Swedish innovative biomedical company that conducts research, development and sales of medical treatments and lifestyle products in the field of women’s health. The company was founded in 2009 and the shares have been traded since 2014 on Spotlight Stock Market in Stockholm. Peptonic has divided its operations into two business areas,” Medical Consumer” and “Lifestyle Consumer”. Peptonic’s business area “Medical Consumer” is based on clinically proven intimate self-care and constitutes the Company’s main focus and is sold under the brand name VagiVital. Peptonic’s business area “Lifestyle Consumer” consists of lifestyle products that focus on menstruation, sex and fertility and is sold under the brand name Lunette.

The company’s business model is based on developing reference markets in the Nordics with sales primarily in physical pharmacies and online pharmacies as well as via its own online stores. With a growing portfolio and functioning reference markets as a basis, the company will eventually expand its own brands internationally through collaborations with local distributors with the aim of achieving profitability in more markets. In parallel, the company works with license manufacturing with selected international partners who sell Peptonic’s products under their own brand names in most markets.

The company’s vision is to enable women to live the life they desire by offering innovative, clinically proven, high-quality, and accessible intimate care products and services, which help relieve the burden on healthcare systems worldwide.

The company’s mission is to create a portfolio of products according to the concept of diagnose, treat, prevent, which means that the consumer with the help of the Company’s products should be able to manage their intimate health through all stages, from diagnosis to treatment and prevention of diseases and conditions.

In 2022, Peptonic introduced a new strategy and divided the company’s operations into two areas, Medical Consumer and Lifestyle Consumer, where Medical Consumer is the company’s core business.

For medical conditions in intimate health, there are prescribing products and self-care products. Peptonic’s goal is to position the company between these, with clinically proven intimate self-care and have a leading role with a clear position and profile. The company’s ambition is to achieve this by developing and acquiring an innovative product portfolio that enables the female consumer to manage their intimate health from diagnosis to treatment and to prevent diseases and conditions.

Within the Medical Consumer business area, Peptonic works with a clinically proven and innovative self-care portfolio that enables the consumer to diagnose, treat and prevent vulvovaginal disease. Currently, the company focuses on diseases and ailments such as bacterial vaginosis, fungal infections, vaginal atrophy, vestibulitis, urinary incontinence, urinary tract infections and amniotic fluid leakage.

Peptonic’s productsin the Medical Consumer business area are sold under the brand name VagiVital. Peptonic’s vision for VagiVital’s products is to enable women to live the life they want throughout their lives. This is achieved through the above-mentioned self-care portfolio profiled with a positive appropriation and a tonality towards lifestyle and well-being rather than medicine. VagiVital’s communication platform reflects seriousness mixed with humor and warmth. The intention is to make it more convenient and attractive to shop for intimate care products and thus eliminate the barrier of embarrassment to one who may stand in the way of seeking help.

VagiVital VS – Self-test to diagnose vaginal infections

VagiVital VS self-test can diagnose symptoms of bacterial vaginosis and vaginal fungal infections with 92 percent accuracy. The test is carried out on vaginal fluid and indicates the response within 30 seconds by color change. The result is based on a combined indication of Ph level and buffer capacity in the floating. The two-stage mechanism is patented and allows the VagiVital VS to have much higher precision compared to conventional pH tests. The advantage over the tests submitted to the laboratory is that the result is obtained immediately with VagiVital VS.

VagiVital AL – self-test to detect amniocentesis leakage

VagiVital AL is a self-test that makes it possible to detect leaking amniotic fluid during pregnancy in case of experienced unidentified fluid leakage. The self-test consists of a pad with a patented biofilm on the surface of the pad. When used, the pad is placed in the panty and must remain there until the pregnant woman experiences moisture. Then the bandage is taken out. 15 minutes after the pad is removed, the result can be read and then differentiates between amniotic fluid leakage and urine with 97 percent accuracy.

The mechanism behind the high and clinically proven precision is a patented two-step mechanism that measures pH and binding of, among other things, ammonia to receptors in the biofilm that at certain concentrations gives a color change.

The self-test is used by pregnant women at home or in a medical clinic with professional help, where gynecological clinics and maternity wards constitute primary target groups. The test is non-invasive and, according to the company, is the only test with an evidence-based precision comparable to standardized gynecological measurements. The test is so sensitive that it can detect very small volumes of amniotic fluid and can thus reduce misdiagnosis and incorrect treatments of patients.

VagiVital AktivGel – Treatment for vaginal atrophy/ vaginal dryness

VagiVital AktivGel is a hormone-free treatment for symptoms linked to vaginal atrophy such as pain during intercourse, burning, itching and dryness. The product offers an alternative for women who cannot or should not use hormone-based drugs and has a positive clinically proven effect according to the Company’s study r from 2017 and 2020. The results of the studies showed severe relief of symptoms such as vaginal dryness, itching and intercourse pain. In addition, vaginal pH is normalized as a result of treatment with VagiVital AktivGel.

VagiVital Moisturizing V Cleanser

Perfumed products and soaps risk drying out the vaginal mucosa and can lead to vaginal atrophy and/or vaginal infections such as bacterial vaginosis. VagiVital Moisturizing V Cleanser is based on VagiVital AktivGel in combination with a botanical oil. The product allows cleaning of both water- and oil-soluble impurities while moisturizing unlike an oil-based intimate wash.

In Sweden, the products are sold mainly in pharmacies, partly digitally and in a growing number of physical stores as well as through the brand’s online store. Internationally, VagiVital’s products are mainly sold through regional distributors in medical technology. The company also works with selected partners who, through license manufacturing, sell VagiVital’s products under their own brand names. VagiVital’s products are also sold through international partnerships under the selling partner’s own brand. It is the Company’s goal that the share of sales under its own brand VagiVital increases towards sales through license partners.

Vaginal atrofi

Vaginal atrophy is a disease that means that the mucous membranes in the woman’s genital area become thinner and more fragile, the disease affects millionsof women worldwide every year. Vaginal atrophy is a medical condition that affects about 40 percent of menopausal women. A woman enters menopause around the age of 45 – 55, at this time the body’s own production of the hormone estrogen decreases, which can cause problems such as vaginal dryness, irritation and itching as well as pain during intercourse. The Journal of Sexual Medicine published results from an international study that showed that about 40 – 75 percent of women affected by vaginal atrophy do so within five years of menopause, which is the occasion when women stop menstruating. In as tudie of TEFEN and Peptonic, s estimated the value of the total market for drugs for vaginal atrophy in the US, Germany, Spain, the UK, Italy, and France at approximately SEK 24 billion per year. The Nordic self-care market, where the woman herself pays for the treatment, which constitutes the part of the market that Peptonic addresses, was estimated to amount to just under SEK 100 million. The hormone-free part of this makes up about 40 percent.

Vaginal atrophy is an undertreated medical problem around which there is a cultural and social stigma. The symptoms are often associated with sexuality and are something that many women experience as embarrassing or stigmatized to seek help for from family, friends or the healthcare system and there is probably a dark number about how common the disease is among women. The percentage of women in the United States who exhibit symptoms of postmenopausal vaginal atrophy is about 40 percent and research show that some of these women disregard or believe that the symptoms are a natural part of aging and therefore do not seek available care,. With an aging population and increased awareness of women’s health in general and vaginal atrophy in particular, the market and willingness to pay for treatments are expected to grow over the next ten years.

Bakteriell vaginos

In the vagina there is a natural bacterial flora, bacterial vaginosis means that there has been an imbalance among the bacteria, which causes foul-smelling vaginal discharge. Bacterial vaginosis is a common disease that affects a large part of the world’s women with a high risk of disease recurrence after the patient has got rid of their problems. Even though the disease has a high prevalence among women, the range of treatments and diagnosis has been relatively limited historically but is something that changes as the market grows. In 2021, the global market for the treatment of bacterial vaginosis was valued at approximately USD 962 million and the market is expected to assume an annual average growth of approximately 8.7 percent between 2022 and 2030 when the market is predicted to be worth approximately USD 1.697 billion. The growth is primarily driven by research and development activities as a result of an increased awareness of women’s health. Other important growth factors are a globally growing healthcare sector, an increased availability of diagnostic tools and drugs, and various technological advances in the pharmaceutical and healthcare industries.

In a study conducted by the CDC, the prevalence of bacterial vaginosis was mapped in the United States. The results showed that almost one in three women in the age range 14 – 49 years had bacterial vaginosis corresponding to approximately 21.4 million women. On the Swedish market, several studies show a prevalence of bacterial vaginosis among women in the age range 15-49 years of about 30 percent. The relatively high prevalence of bacterial vaginosis suggests a high need for diagnostic options and enables women to seek relevant care.

Amniotic fluid leakage

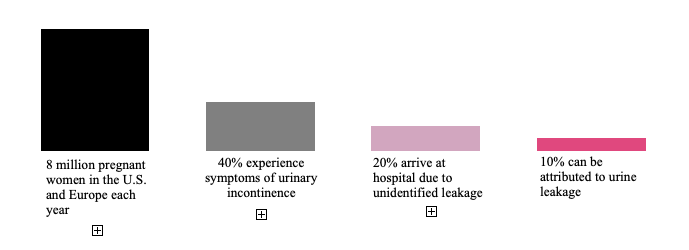

About 8 million babies are born annually in the United States and Europe, and about 10 percent of these births begin with amniocentesis. Furthermore, 40 percent of all pregnant women in Europe and the United States experience symptoms from urinary incontinence and 20 percent of pregnant women arrive at hospitals with wetness. Of these, half can be attributed to urine leakage and thus entail an unnecessary burden on the healthcare system.

Premature amniocentesis is a potentially serious ailment and occurs at about 5 – 15 percent of all pregnancies. Many cases of suspected amniocentesis turn out to be urine, which leads to unnecessary costs and efforts for care. In the event of premature amniocentesis, both fetus and mother can suffer from complications such as lack of amniotic fluid, premature placental abruption, various infections, umbilical cord prolapse as well as bleeding and premature delivery. These complications pose a danger to both fetus and mother and, in the worst case, can be fatal. In view of the serious risks posed by premature amniocentesis, the market for diagnosis is predicted to grow as knowledge and supply of diagnostic products increases.

Growing market for self-testing

The global market for self-tests has grown in recent years and in 2021 the market was valued at approximately USD 6.7 billion and is expected to grow with an annual average growth of approximately 5.3 percent to a value of approximately USD 8.1 billion in 2028. In Sweden, the self-care market also shows a growth of just over 4 percent. In one study, consumers’ web searches related to disease diagnoses were mapped which showed that consumers were most interested in searching for self-tests for diagnosis. Covid-19 is believed to be a contributing factor to the increased interest in self-care as well as an influencing factor in the increased acceptance of self-testing. In addition, the availability of self-tests has increased in parallel with the growth of e-commerce for pharmaceuticals and related products.

Currently, a study is underway with an adapted variant of VagiVital AktivGel for the treatment of vaginal fungal infections.

VagiVital AktivGel has passed international patent review for treatment against vestibulitis. Evaluation is currently taking place for the next step in the process.

Ongoing process to get VagiVital AL approved for the US market. The work is ongoing in collaboration with one of the Company’s American partners.

In the subsidiary Peptonic Medical Israel, development work is planned to produce a product that diagnoses insidious urinary tract infections using the technology used in VagiVital AL.

Within the Lifestyle Consumer business area, Peptonic works with lifestyle-oriented products. The company mainly focuses on durable menstrual products such as menstrual cups, menstrual cloth pads and menstrual panties, where menstrual cups are the main product for the business area. In addition to sustainable menstrual products, products for desire and intimate balance are also offered.

Peptonic’s products in the Lifestyle Consumer business area are sold under the Lunette brand. For more than 15 years, Lunette has worked for a world that is safe, inclusive, and sustainable by facilitating the management of menstruation with climate-smart menstrual products. Lunette’s efforts and work have resulted in the UN appointing Lunette as a formal partner and 99 percent of users recommending Lunette’s products.

Lunette menstrual cup

Lunette Menstrual cup is a menstrual protection in the form of a small bell-shaped cup that is inserted into the vagina and is made from material that is medically approved for intimate use. The menstrual cup offers good leakage protection, does not interfere with the normal functioning of the body, is hygienic, more cost-effective, and more durable than alternatives such as tampons and pads. Since April 2022, Lunette is the official “Menstrual Cup Partner” of the UN, which means that their menstrual cups are included in the UN’s “period host package”. Which means that the UN buys products for the “period hosting package” from the selected suppliers and then distributes the packages internationally completely free of charge. The partnership is initially valid for three years with a potential extension of two years.

Lunette cloth menstrual pads

Lunette cloth menstrual pads are suitable for use during menstruation, mild incontinence or as an additional protection together with Lunette’s menstrual cup. The cloth menstrual pads are gentle on the skin and reusable. The pads are made in Finland from three different Ökö-Tex certified fabrics; organic cotton, bamboo viscose with high absorbency and polyester that does not let moisture through. The cotton in the cloth napkins is organically certified with a so-called Control Union certificate. The durable pads offer a convenient and environmentally friendly alternative to disposable materials.

Other related products

In addition to menstrual cups and cloth pads, Lunette offers a wide range of other products in intimate health. For example, Lunette Intimate Cleanser which is a soap-free intimate wash, Lunette Intimate Wipes which is 100 percent biodegradable wipes, Lunette Moodsmooth Remedy oil, Lunette menstrual panties and products related to Lunette menstrual cups. Lunette also sells Lunette Lube as well as Lunnette Condoms, in addition they are retailers of a diverse range of products in desire and intimate balance.

Globally, Lunette’s products are sold both online and in physical stores. The distribution channels are pharmacies, retail stores, Amazon, and other online players, as well as the company’s own online stores. With more than three million relevant visitors to Lunette’s own websites per year, the brand has become a “community” where women turn for answers to questions about menstruation, fertility, and sex. According to the Company, this represents a great potential for an increased demand for the brand’s products. Which, combined with Lunette focusing on fewer markets, will increase the brand’s competitiveness.

Mensskydd

The market for menstrual cups is under development and was valued in 2020 at approximately USD 559 million. As product awareness increases, the market is expected to adopt an annual average growth rate of approximately 4 percent by 2027 and then valued at approximately USD 735 million. In a study conducted by Lunette, 70 percent of the responding consumers stated that they wanted to continue using Lunette’s menstrual cups after they became familiar with the functionality. In the same survey, a whopping 99.2 percent of respondents stated that they would recommend the product.

The market for period panties is predicted to grow with an annual average growth of 12 percent and in 2031 is valued at USD 275 million. Furthermore, the market for panty protection is expected to grow from USD 2.8bn in 2022 with an annual growth rate of 11.5% to around USD 8.3bn in 2032.

Increased focus on sustainability

In a survey conducted by Lunette, respondents cited environmental aspects as the most important reason they started using menstrual cups. Annually, approximately 500 million tampons and pads are consumed in Sweden alone. Moderna pads and tampons are produced from materials that usually contain so-called super absorbents and traces of plastic. In the manufacturing process, harmful substances are also released and after end use, tampons and pads are burned, which can be harmful to the environment. Furthermore, a large amount of cotton is also used in production, something that requires large amounts of water, for example, 10,000 liters of water are consumed to produce one kilogram of cotton. The above-mentioned aspects underline the fact that the use of menstrual cups can reduce environmental impacts in the form of reduced production, carbon dioxide emissions and waste.

Price aspects and availability

In Sweden, a woman consumes on average about 11,000 disposable feminine care products during her lifetime. In the U.S., a woman spends an average of about $2,000 annually on pads or tampons. In recent years, a debate has arisen about the cost of women’s feminine care products. About 12.8 percent of the world’s women live in poverty and 1.25 billion do not have access to a safe and private toilet.In combination with the fact that menstruation is stigmatized and considered unclean in some countries, girls’, and women’s ability to go to school and to earn a living is affected. It is the company’s opinion that menstrual cups can offer a solution to the above-mentioned problems. In addition, menstrual cups are reusable, which makes them a cost-effective alternative compared to other conventional feminine care products.

The company has sought intellectual property protection for its products in all major markets. Peptonic currently owns two substantial patent families and three applications.

Patent families

Formulation and dose levels in vaginal atrophy. This patent family is accepted in all essential EU/EFTA countries as well as in the USA, Australia, China, Israel, Russia, Turkey, Singapore, Hong Kong, South Korea, and South Africa. The patent provides patent protection until 2032 for the formulation previously usedin the Vagitocin gel with oxytocin. The same gel base is also used in VagiVital.

Peptonic Medical has filed a PCT patent application to protect VagiVital.

Applications

Application to patent the treatment of vestibulitis with the Company’s self-care product VagiVital. The background to this potential indication expansion for VagiVital is the symptom relief VagiVital provides. The application was submitted in May 2020 and the company received a positive opinion regarding the application from the international review authority in September 2022.

Application to patent a developed intimate wash based on VagiVital. The innovation lies in the combination of the water-based gel VagiVital with an oil. The combination provides a product that stands out from other similar products on the market. In 2022, the company received a positive opinion regarding the application from the international review authority.

Application to patent a treatment of intimate fungal infections and bacterial vaginosis. The background to the application is, among other things, positive results from in-vitro studies that show an effective antifungal effect of a newly developed gel based on the same technological platform as VagiVital. The application was submitted in November 2020. The company received a positive opinion regarding the application from the international review authority in September 2022.

Furthermore, Peptonic Medical Israel Ltd owns two substantial patent families;

1. Secretion-Testing Article, patent family that describes how to test Ph values and thereby be able to distinguish when bacterial vaginosis is involved. Approved in Canada, Israel and USA. Valid until November 2023, except in the US where the validity extends to November 2025.

2. Diagnostic Compostion for identifying amniotic fluid, the patent family that protects the new variant of VagiVital AL. Grants are available in, among others, the USA, Brazil, Australia, Japan, China, India, Turkey and all major countries in Europe until the year 2035.

Peptonic Medical holds four approved brand families which are listed below.

VagiVital, which is approved in the EU area, USA and in Norway, the application is available in additional countries

Vagitocin, which is approved in the EU area and in the US

Lunette, via Lune Group Oy

FloriSense, via CommonSense

The company has control over, among other things, the following domain names, which have been considered the most significant;

Peptonicmedical.se and Peptoncimedical.com

Vagivital.se and Vagivital.com

Lunette.fi and Lunette.com